Understanding Your Escrow Account

An escrow account may be set up by your lender to collect and hold funds to pay certain property-related expenses. These expenses often include property taxes, homeowners’ insurance, flood insurance and private mortgage insurance (PMI). An escrow account is a convenient way to have SouthPoint Home Mortgage manage the payment of your tax and insurance bills for you.

How It Works

Your monthly mortgage payment may include an amount to be paid into your escrow account for payment of your property taxes and insurance.

Calculating Escrow Payments

- To set up your escrow account, we'll divide your projected annual tax and insurance bills by 12 and add the resulting amount to your monthly mortgage payment.

- Each month, we’ll deposit the escrow portion of your mortgage payment into the escrow account to pay your insurance premiums and taxes when they’re due.

- We also require a 1 month escrow payment cushion to cover unanticipated costs, such as tax or insurance increases. This cushion is also known as the allowable low balance in your escrow account.

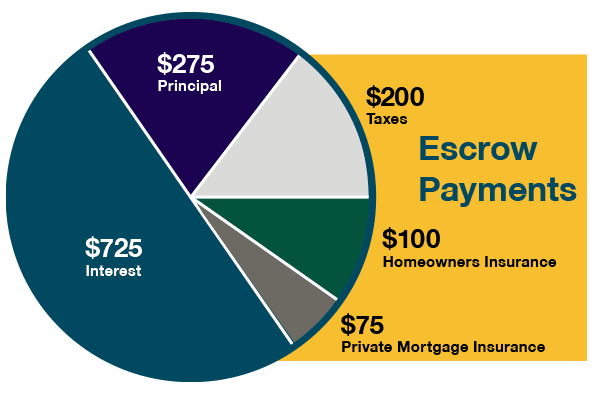

Below is an example of your $1,375 monthly mortgage payment with escrow.

What to Expect

The amount you pay into your escrow account is calculated at closing and then reviewed annually. These payments can increase or decrease as your taxes or insurance premiums change. As your lender, SouthPoint Home Mortgage doesn’t control these costs.

Escrow Analysis

SouthPoint Home Mortgage reviews your escrow account each year to make sure there are enough funds to cover your private mortgage insurance (PMI)***, homeowner's insurance** and/or property taxes. This escrow analysis will show you the amount of taxes and/or insurance paid on your behalf in the past year with the funds from your escrow account. The escrow analysis also highlights what we project to pay next year. At that time, there may be a surplus or a shortage.

Escrow Surplus

A surplus is determined based on the projected balance for the next 12 months. Surplus less than $50.00 will be prorated and your monthly payment adjusted accordingly. A surplus of $50.00 or more will be refunded.

Escrow Shortage

Most commonly, an increase in your property taxes and/or insurance will result in an escrow account shortage.

The shortage amount will be divided into 12 months and added to the mortgage payment. You may choose to pay the shortage in full. To avoid a similar shortage in the upcoming year, your new escrow deposit will be calculated for 1/12 of the current tax and insurance payments. If your current tax and insurance payments are more than the previously projected monthly breakout, you may need to contribute more per month.

Annual Escrow Account Disclosure

An Annual Escrow Account Disclosure statement will be sent at least 30 days prior to your payment change to notify you of any change to your escrow payment. Click the button below for a guide on how to read your statement.

Common Terms

*Escrow Cushion: Funds mortgagor may be required to pay into the escrow account in order to ensure that sufficient funds are available for unanticipated disbursements for escrow items. Typically, the cushion equals two months of escrow payments, unless reduced or eliminated by federal and state law. The lesser amount prevails.

**Homeowner's Insurance: An insurance coverage that compensates the insured in the event of property loss or damage. Insurance is a requirement for all loans. The mortgage agreement requires that the borrower keep the improvements of the property insured against loss by fire, hazards included within the term "extended coverage", and any other hazards, including, but not limited to, earthquakes and floods, for which the lender requires insurance. This includes an HO6 policy for residents of condominiums, which protects "walls-in" items.

***Private Mortgage Insurance (PMI): Provided by privately owned companies on loans with down payments less than 20 percent of the purchase price. The insurance protects lenders in the case of default by mortgagors.

Still have questions about escrow?

Read answers to frequently asked questions here or contact us with your question today.